Stallion Responsive is currently not available to purchase and I have no plans to release any new updates. I’m afraid the time taken on updates vs money from selling a single theme (I don’t get enough sales**) isn’t worth the investment (in time) managing. Stallion Responsive today (November 2017) is still by far the best WordPress SEO package available, so current users will be fine for at a least a year.

** For the record I made the mistake of making Stallion Responsive too complex for the average user, I developed an SEO package for advanced SEO developers (me). The average user wants basic SEO packages like the Yoast SEO Plugin with a handful of options which do very little SEO wise, but feel like they are achieving something after clicking half a dozen options. Real SEO takes time and effort and LOTS of options (hundreds of options) in a real WordPress SEO package, but the average WordPress user doesn’t want real SEO, they want minimal SEO like Yoast offers.

Do you want a WordPress SEO Theme designed by and for an SEO Expert with over 15 years online marketing experience?

My SEO journey began in 2001, Google wasn’t even three years old.

I started an online business selling products on a new ecommerce site (see my CV for details). I didn’t have a clue about web design, online marketing or SEO and with an annual marketing budget of under £500 I couldn’t afford to pay for traffic or expert help!

I had no choice but to learn everything required to build and run a successful online business, including how to gain masses of free organic search engine traffic: million of organic visitors a year.

15+ years later, Google is old enough to vote (how quickly they grow up), I’m proficient in search engine optimization, online marketing and have developed the Stallion Responsive WordPress SEO Theme.

Stallion Responsive Theme

Stallion Responsive is the most advanced/feature rich WordPress SEO Theme on the market and you can try the FULL product for free via the download links below.

When ready to buy a full theme license, use the Get It Now button below.

Trust Onsite WordPress SEO to Stallion Responsive

Trust is so important in business, everyone is trying to part you from your hard-earned cash, you need partners who deliver results.

I’ve been developing Stallion Responsive for over 10 years, not to sell per se, but to use on my WordPress sites: I’ve been a WordPress user since 2006 and NEEDED a WordPress SEO theme, since none existed, I created one.

I’ve taken multiple new sites from zero visitors to over 10,000 unique free organic search engine visitors per day in under a year using search engine optimization techniques.

Using affiliate marketing techniques in combination with SEO I’ve sold over $400,000 worth of Amazon products on a simple Classic Literature site built from free public domain content: a complete novice could build a site like this.

My WordPress sites have earned hundreds of thousands of dollars from the Google AdSense program from free organic search engine traffic: I never pay for traffic.

As a Freelance SEO Consultant (for ~12 years) I’ve had small-medium size businesses retain SEO services for periods measured in years: longest freelance contract was over 8 years.

I’ve supported my theme/plugin users (for free) for over 10 years, look through this sites 4,000+ user comments using the comments search form below.

Note 1: The ability to search through comments is a Stallion Responsive feature you won’t find in other themes.

Note 2: The form above is added as a custom widget area directly into a WordPress Pages/Posts content, another Stallion Responsive feature you won’t find in other themes.

WordPress Developers SEO Framework

Stallion Responsive is technically a WordPress theme, but in reality it’s a WordPress developers SEO framework consisting of dozens of WordPress plugins and custom SEO code features: install Stallion Responsive like any theme and the entire SEO package is available via a set of options pages.

You will have access to features like the comment search form above, the ability to create custom widget areas which can be added inside Page/Post content like the two popular posts widgets (which include silo SEO options) below and dozens of other cool features.

You get all these features in one theme for one price: currently only $30.00.

So Many WordPress SEO Features

Stallion has so many builtin features I’ve started pulling them out and releasing them as stand alone WordPress SEO plugins to make updates and improvements easier to manage/maintain: yes, I’ve added too many features!

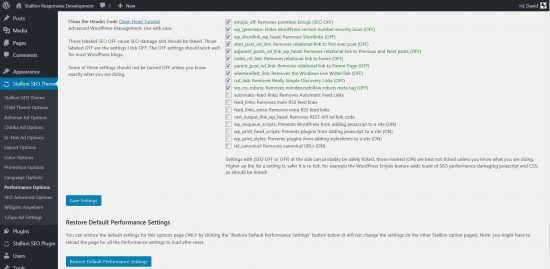

Above is a screenshot from one of the dozen plus Stallion Responsive options pages showing a small subset of performance SEO options (there’s hundreds of theme options). What you see in the screenshot could easily be released as a premium WordPress SEO Performance plugin.

Install Stallion Responsive (see the links to the zip files above), check out all the Stallion SEO Theme Option pages and imagine what it would cost if Stallion Responsive was split into dozens of premium SEO products.

Free WordPress SEO Plugins

Stallion Responsive Theme Features

There are over a dozen Stallion Responsive Theme options pages giving the WordPress site owner access to hundreds of options. WordPress is primarily designed to be used as a blogging platform, but it can be so much more.

Maybe you want a WordPress site with Blog like features, set the right options and your sites a Blog.

Maybe you want a site with few Blog like features, set the right options and WordPress becomes a general Content Management System (CMS).

Or maybe you want some parts of the site to be Blog like and others not, it’s all possible with Stallion Responsive.

Below is a taste of Stallion Responsive features: NOT a comprehensive list.

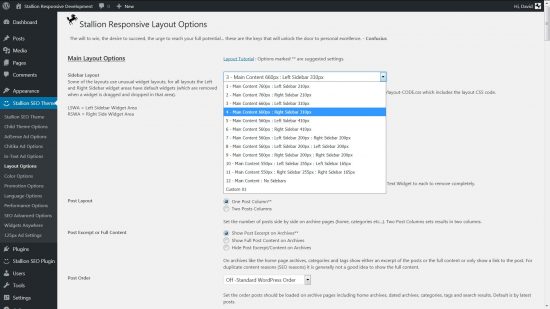

12 Mobile Responsive Theme Sidebar Layouts

- Main Content 760px : Left Sidebar 210px

Two column layout with one 210px wide sidebar on the left - Main Content 760px : Right Sidebar 210px

Two column layout with one 210px wide sidebar on the right - Main Content 660px : Left Sidebar 310px

Two column layout with one 310px wide sidebar on the left - Main Content 660px : Right Sidebar 310px

Two column layout with one 310px wide sidebar on the right - Main Content 560px : Left Sidebar 410px

Two column layout with one 410px wide sidebar on the left - Main Content 560px : Right Sidebar 410px

Two column layout with one 410px wide sidebar on the right - Main Content 560px : Left Sidebar 200px : Right Sidebar 200px

Three column layout with two 200px wide sidebars - Main Content 560px : Left Sidebar 200px : Left Sidebar 200px

Three column layout with two 200px wide sidebars on the left - Main Content 560px : Right Sidebar 200px : Right Sidebar 200px

Three column layout with two 200px wide sidebars on the right - Main Content 550px : Left Sidebar 255px : Left Sidebar 165px

Three column layout with one 255px wide sidebar and one 165px sidebar both on the left - Main Content 550px : Right Sidebar 165px : Right Sidebar 165px

Three column layout with one 255px wide sidebar and one 165px sidebar both on the right - Main Content : No Sidebars

One column (main content) layout, the left and right sidebars and the footer sidebars are loaded below the main content (add blank text widgets to have blank)

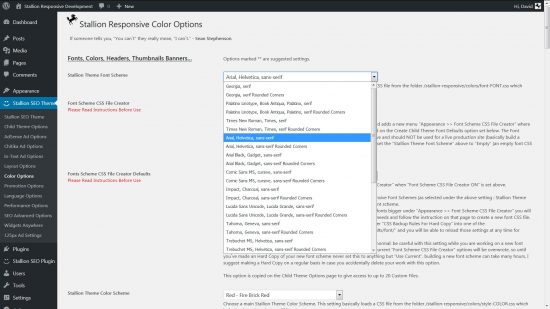

26 Font Schemes

- Georgia, serif

- Georgia, serif Rounded Corners

- Palatino Linotype, Book Antiqua, Palatino, serif

- Palatino Linotype, Book Antiqua, Palatino, serif Rounded Corners

- Times New Roman, Times, serif

- Times New Roman, Times, serif Rounded Corners

- Arial, Helvetica, sans-serif

- Arial, Helvetica, sans-serif Rounded Corners

- Arial Black, Gadget, sans-serif

- Arial Black, Gadget, sans-serif Rounded Corners

- Comic Sans MS, cursive, sans-serif

- Comic Sans MS, cursive, sans-serif Rounded Corners

- Impact, Charcoal, sans-serif

- Impact, Charcoal, sans-serif Rounded Corners

- Lucida Sans Unicode, Lucida Grande, sans-serif

- Lucida Sans Unicode, Lucida Grande, sans-serif Rounded Corners

- Tahoma, Geneva, sans-serif

- Tahoma, Geneva, sans-serif Rounded Corners

- Trebuchet MS, Helvetica, sans-serif

- Trebuchet MS, Helvetica, sans-serif Rounded Corners

- Verdana, Geneva, sans-serif

- Verdana, Geneva, sans-serif Rounded Corners

- Courier New, Courier, monospace

- Courier New, Courier, monospace Rounded Corners

- Lucida Console, Monaco, monospace

- Lucida Console, Monaco, monospace Rounded Corners

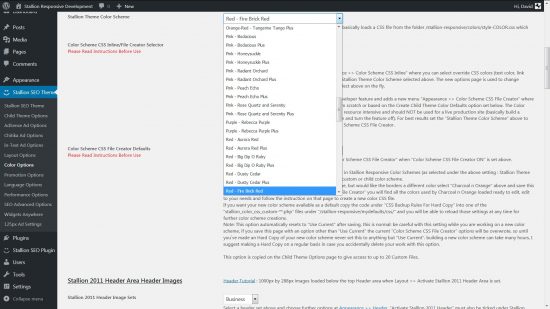

112 Colour Schemes

- Blue – Airy Blue

- Blue – Airy Blue Plus

- Blue – Blue Izis

- Blue – Blue Izis Plus

- Blue – Cosmic Cobalt

- Blue – Cosmic Cobalt Plus

- Blue – Dazzling Blue and Cayenne

- Blue – Dazzling Blue and Cayenne Plus

- Blue – Facebook Blue

- Blue – Facebook Blue Plus

- Blue – Limpet Shell

- Blue – Limpet Shell Plus

- Blue – Riverside

- Blue – Riverside Plus

- Blue – Serenity

- Blue – Serenity Plus

- Brown – Burlywood

- Brown – Burlywood Plus

- Brown – Iced Coffee

- Brown – Iced Coffee Plus

- Brown – Maroon

- Brown – Maroon Plus

- Brown – Marsala

- Brown – Marsala Plus

- Brown – Potters Clay

- Brown – Potters Clay Plus

- Brown – Warm Taupe

- Brown – Warm Taupe Plus

- Cyan – Turquoise

- Cyan – Turquoise Plus

- Gray – Dark Slate Gray

- Gray – Dark Slate Gray Plus

- Gray – Light Slate Gray

- Gray – Light Slate Gray Plus

- Green – Emerald

- Green – Emerald Plus

- Green – Forest Green

- Green – Forest Green Plus

- Green – Green Flash

- Green – Green Flash Plus

- Green – Lush Meadow

- Green – Lush Meadow Plus

- Green – Light Sea Green

- Green – Light Sea Green Plus

- Orange – Small Tortoiseshell Butterfly

- Orange – Small Tortoiseshell Butterfly Plus

- Orange – Spring Tangerine

- Orange – Spring Tangerine Plus

- Orange-Red – Tangerine Tango

- Orange-Red – Tangerine Tango Plus

- Pink – Bodacious

- Pink – Bodacious Plus

- Pink – Honeysuckle

- Pink – Honeysuckle Plus

- Pink – Peach Echo

- Pink – Peach Echo Plus

- Pink – Radiant Orchard

- Pink – Radiant Orchard Plus

- Pink – Rose Quartz and Serenity

- Pink – Rose Quartz and Serenity Plus

- Purple – Rebecca Purple

- Purple – Rebecca Purple Plus

- Red – Aurora Red

- Red – Aurora Red Plus

- Red – Big Dip O Ruby

- Red – Big Dip O Ruby Plus

- Red – Dusty Cedar

- Red – Dusty Cedar Plus

- Red – Fire Brick Red

- Red – Fire Brick Red Plus

- Yellow – Mimosa

- Yellow – Mimosa Plus

- Yellow – Spicy Mustard

- Yellow – Spicy Mustard Plus

- White BG – Clean White n Hint of Blue

- White BG – Clean White n Hint of Red

- White BG – Clean White n Hint of Rebecca Purple

- White BG – Clean White n Hint of Sea Green

- Light BG – Light

- Light BG – Light n Hint of Classic Blue

- Light BG – Light n Hint of Marsala

- Light BG – Light n Hint of Sinopia

- Light BG – Light n Hint of Treetop Green

- Light BG – White n Red

- Light Blue BG – White n Light Blue

- Dark Blue BG – White n Dark Blue

- Marsala BG – White n Marsala

- Dark BG – Dark

- Dark BG – Black n White

- Dark BG – Black n Blue

- Dark BG – Black n Red

- Dark BG – Black n Green

- Dark BG – Neon Green

- Dark BG – Neon Pink

- Dark BG – Neon Purple

- Dark BG – Neon Red

- Dark BG – Neon Yellow

- Dark BG – Charcoal n Orange

- Dark BG – 50 Shades of Grey

- Dark BG – Cyan vs Gray

- Dark BG – Midnight Slate

- Blue BG – Blue Door Tones by Marie

- Blue BG – Night Sky by Marie

- Brown BG – Coffee Cup

- Green BG – Green Tea Tones by Marie

- Light BG – Fresh n Green by Marie

- Yellow BG – Celebrate by Marie

- Blue – The Tale of Peter Rabbit

- Blue – The Tale of Peter Rabbit Plus

- Brown BG – PB I Want My Hat Back

- Brown BG – PB I Want My Hat Back Plus

- Basic Defaults – Light BG – Blue n Red Links

Each Layout/Font/Colour Scheme can be used sitewide AND on a Post by Post basis (unique Stallion Responsive design feature).

With 12 layouts, 26 font schemes and 112 colour schemes there are 34,944 (12 x 26 x 112) possible combinations of layout/font/colour scheme. If you own a site with 34,944 posts each Post could have a different combination. If that’s not enough design choices, ALL the font schemes and colour schemes can be modified (via options pages) to either tinker with the output OR design an entirely new look.

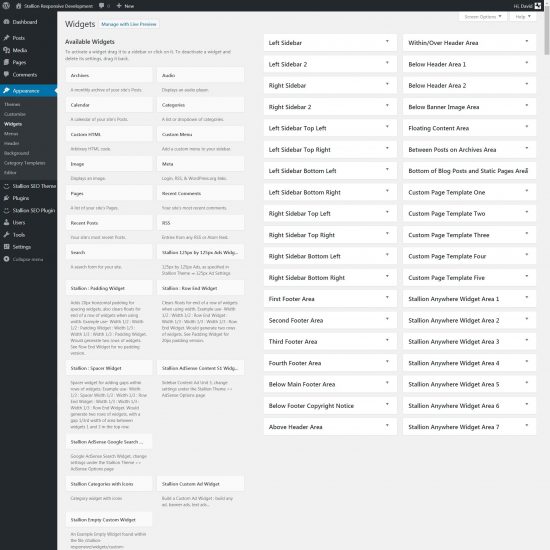

Custom Widget Areas

Built around 26 Standard Widget Areas and an unlimited number of Custom Widget Areas (for adding to Custom Page templates) and Stallion Anywhere Widget Areas (add a widget area and it’s widgets inside a Pages/Posts content: see earlier examples). The screenshot below shows the output of the widgets options page (“Appearance” >> “Widgets”) with Stallion Responsive active.

Customize The Design

There’s an entire options page (the Layout Options page) devoted to customizing the basic design of your site. With most WordPress Themes if you want an unusual design you have to modify PHP template files! With Stallion Responsive almost anything is possible with a few clicks of the mouse (you can of course still create customized Page templates).

Below are some of the possible design choices, many of the options below are also available on a Post by Post basis: each Page/Post can have it’s own unique design.

Multiple header image options.

Tagline location : within the header, below the footer or not at all.

Posts meta area location : above the content, below the content or disabled.

Posts meta area elements (the Page/Post date for example) : each can be enabled/disabled (full design control).

Enable/Disable The Search Form.

Enable/Disable The Continue Reading links (on archives).

Enable/Disable The Author Biography Box (on Pages/Posts).

Enable/Disable The Comments on Attachment Pages : yes, image attachment pages can have comments.

Enable/Disable The Comment Gravatars : hide them to be less blog like.

Enable/Disable The Comment Dates : hide them to be less blog like.

Enable/Disable The Comment Button Link (on archives).

Enable/Disable The Scroll Top/Bottom Arrows.

Enable/Disable The WP Admin Bar : it’s annoying.

Enable/Disable The Photo Navigation Menu : have a menu with images.

Enable/Disable The Navigation Menu Primary : standard menu.

Enable/Disable The Navigation Menu Secondary : have a second menu.

Enable/Disable YouTube Comments Embed : WordPress by default doesn’t embed videos in comments.

Enable/Disable Widget Display Features : determine where widgets load.

Enable/Disable Widgets Anywhere : add a widget almost anywhere.

Enable/Disable Widget Columns : split widget areas into multiple columns.

Enable/Disable Widget Shortcodes.

Enable/Disable Code Output Features : WordPress by default is terrible with PHP/HTML code posted in Posts etc…

Enable/Disable Better Search Excerpt : create a search engine optimized excerpt.

Enable/Disable Custom Templates : allows Page templates to work with Posts and adds Category templates.

Multiple options for how tags are shown (or not) on archives and Posts.

Even More SEO Features

Uses Yoast and/or All In One SEO Data : not just as the title tags, but for so much more including internal anchor text

Four Additional Keyword Phrases (similar to the Yoast/All In One SEO Title Tags) for EVERY Post/Page : used for internal links to Posts adding SEO value to internal links

Optimized Title Tags : choose from branded and unbranded title tags

Custom Meta Description Tags : Google uses them like ads for a pages SERPs

DMOZ/Yahoo Directory Robots Meta Tags : block Google from using the DMOZ description!

Cleaner Head Code Area : clean up a lot of the mess WordPress adds to the head code for better performance SEO

SEO Posts Widgets : an SEO widget for showing Recent/Popular Posts

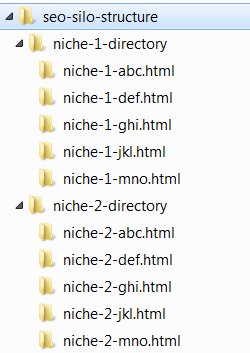

Silo SEO Widget Options : build silo link structures via the SEO Posts Widgets

Optimized Header Tags : avoid damaging sitewide H1-H6 tags with no SEO value

Optimized H1 Header Tags : many themes have the sitename/link within a H1 header sitewide!

Optimized Search Results Pages : via search engine optimized search excerpts

Optimized Sitemap Page Templates : multiple sitemap Page templates (generate simple HTML sitemaps)

Optimized Recent Comments Page Template : a Page template for your recent comments

Optimized Comment Headings : many themes use H* header tags with no SEO value

Optimized Recent Comments Widget : the nofollow links to author sites have been removed

Optimized Thumbnails : automatically create small thumbnail images for use in widgets etc…

Optimized Random Thumbnails : useful for low quality site with no images

Optimized Gravatar Images : create a local Gravatar cache for improved performance SEO

Optimized Continue Reading Anchor Text : so many themes use “Continue Reading” as the anchor text!!!

Stallion SEO Super Comments Built in Plugin : output your comments as stand alone webpages (SEO Comment Posts) potentially increasing Google traffic

Optimized Comment Titles Built in Plugin : give comments a title, the titles are used on the SEO Comments Posts adding additional SEO value

Built in Link Cloaking Script : into affiliate marketing, cloak your affiliate links

Comment Author Links Control : many themes have no control over comment author links, enable/disable author links or output the links in a form Google doesn’t consider a link

All WordPress Nofollow Links Removed : nofollow links delete SEO link benefit, WordPressby default adds lots of nofollow links!!!

SEO Friendly Login Links : don’t waste link benefit on WordPress login links

SEO Friendly Code Layout : sidebar and footer HTML code and in some designs the header nav menus code is loaded BELOW a pages main content, this mean your important content is ‘seen’ by Google first

SEO Neutral Sidebar Headings : many themes use H* headers for widgets wasting SEO value

Social Network Promotion

There’s an options page devoted to promotion based features.

- Open Graph Meta Tags

- SEO Facebook Like Button

- SEO Twitter Tweet Button

- SEO Google +1 Button

- SEO Pintrest Button

- SEO Stumbleupon Button

- SEO Linkedin Button

- SEO Reddit Button

- Flickr Widget

- YouTube RSS Feed Widget

- Google Translation Widget

- SEO Social Network Profile Links

- Google Analytics including AdSense Tracking

- Google Authorship

- FaceBook App or Admin ID

- Google Site Verification

- Bing Site Verification

- Alexa Site Verification

- Pinterest Site Verification

- Verification of any Service

- Author Biography Box

Multiple Built-In Ad Networks

Some of the ad networks below are difficult to incorporate into a WordPress theme, it’s a ready to go with Stallion.

- AdSense Ready

- Chitika Ready

- Kontera Ready

- Infolinks Ready

- 125px x 125px Banner Ads Widget

- Custom Banner Ads Widget

Still NOT Convinced?

Stallion Responsive runs on this website and the vast majority of my network, without Stallion I wouldn’t be living mortgage/debt free in a four story, nine bedroom ex-guesthouse in a small seaside town on the UK’s east coast with no money worries.

I can’t guarantee you can live mortgage free in a few years, but can guarantee if you use Stallion Responsive you’ll have the very best onsite SEO possible from a WordPress site: one less thing to worry about.

David Law